SlabStox Card Market Report: October 2022

Is there justified skittishness about the sports card market? Or is the noticeable drop of values during October an over-reaction from buyers who overpaid for a quick flip during the worst time to buy? We think October will go down as one of those great “learning months” in the sports card market. This month, SlabStox digs in and gets a sense of where the market is, where it is going and what we should learn from it.

Here’s what we’re talking about in this October look back at the card market:

- Take 1: Why rare card oversupply has led to BIG losses

- Take 2: Baseball’s playoffs: Harper vs. Judge

- Take 3: Basketball and hockey are BACK

- Take 4: Glance at the Markets

- Take 5: Who’s Hot / Who’s Not

- Looking ahead: Shows, product releases and a Final Word

Join the CardTalk/SlabStox Pod to enter the fray as SlabStox Aaron and Card Talk’s Lou Geneux discuss, debate and disagree (at times) about this monthly Card Market Report. Stay tuned to social media for updates.

If you want to receive this SlabStox Card Market Report every month in your inbox, subscribe to SlabStox’s Daily Slab newsletter.

DISCLOSURES:

- All market data in this report is from Card Ladder. Card Ladder is an independent, third-party partner of SlabStox, providing card collectors and investors insights to make informed, data-driven decisions. Every investment and trading move involves risk. Do your research before making any decision.

- The only cards owned by SlabStox of players in this report are Leon Draisaitl, Connor McDavid, Erling Haaland and Giannis Antetokounmpo

5 Takes from the October Sports Card Market

Take 1: Why rare card oversupply has led to BIG losses

If you’ve lived through the last two years of the sports card market, you’d know one of the biggest cornerstone strategies is to sell your high population cards and buy low numbered, rare cards of players you believe in. That philosophy is not a bad one; it actually makes great sense.

Broken down:

- Buy a card that doesn’t get sold often

- Hold it long enough and eventually a new collector steps up who wants to own it too

- Buyer pays a premium price because your rare card rarely gets listed

- Seller receives solid return

HOWEVER, this strategy isn’t foolproof. Welcome to October! We saw the ugly side of the “rare” card market in a big way.

In theory, the rare-card strategy outlined above sounds great, but that’s based on the assumption the purchaser holds the card for an adequate period of time and sells it once there is a change in the card’s market perception. There’s no question the overall market has lost value since the start of the year, and we’ve been covering it for months. Owners of rare cards can weather the storm if they didn’t overpay to begin with and they don’t “need” to sell.

Here’s the trend we saw in multiple sports card marketplaces in October, a recipe for disaster:

- Buyers paid premium prices for rare cards

- These cards were relisted and resold in a matter of months on auction in hopes of a quick flip or in many cases to try to limit market losses in a falling market

- Seller gets strapped with a huge loss because of lack of patience and an oversupply of the exact same rare card

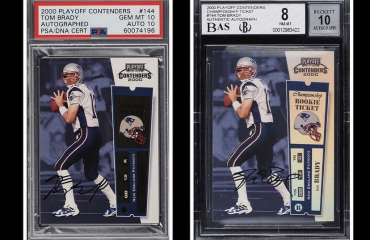

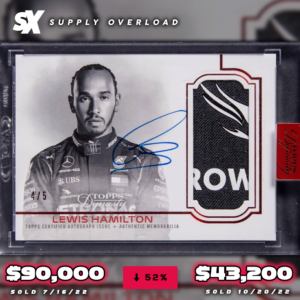

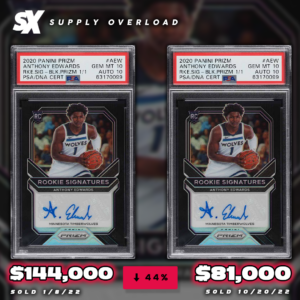

Here are some examples of the EXACT SAME CARD purchased and sold on auction in the year 2022. All cards are numbered /5 or less and are “grails” for each individual player. All are victims of “supply overload.” Below each card is the comparable market trend of higher POP cards of each player:

High Population (POP) Comparison

- Connor McDavid 2015 Young Guns RC PSA 10 (since 6/4/22): +2%

- Leon Draisaitl 2014 Young Guns RC PSA 10 (since 6/4/22): -21%

High POP Comparison

- Tom Brady 2000 Bowman Chrome RC PSA 10 (since 7/21/22): -33%

High POP Comparison

- Lewis Hamilton 2020 Topps Chrome Refractor PSA 10 (since 7/16/22): -14%

High POP Comparison

- Anthony Edwards 2020 Prizm Silver RC PSA 10 (since 1/8/22): -14%

High POP Comparison

- Khabib Nurmagomedov 2017 Topps Chrome Base PSA 10 (since 6/4/22): -10%

All these high-end “rare” cards declined 40% to 70% in just months. The biggest question is: “How does that happen?” It’s pretty simple. The velocity these cards were listed and resold (on auction!) hurt the values immensely.

What should we learn from October’s auctions?

Why have these particular rare cards performed FAR WORSE than the high population cards being sold on auction?

- When a grail is purchased at auction, the buyer is fighting against a group of collectors who also want the card.

- Often it results in a bidding war between two people willing to pay a high price for the card. Here’s one scenario that can play out:

- If you are willing to pay $15,000, the next buyer is willing to pay $14,000, but a third person is only willing to pay $7,000, that creates a huge risk when trying to flip it months later in another auction.

- Here’s why:

- You are now removed from the bidding pool

- The likelihood the same collectors are “excited” about the card again months later to cause a bidding war decreases due to short attention spans and/or not even seeing the card get listed for sale again

- Even if the exact same bidding pool exists, the card would sell for $8,000 the second time at auction because the third person was only willing to pay up to $7,000

- A fundamental principle and the allure of grail cards is they are not available often. And once they do pop up for sale, the assumption is they will be bought by a collector that wants to hold the card. Not someone who buys it and NEEDS to flip it within months.

- Typically, a card that appears on public auction for the first time creates a rush to “lock the card up.” If that same card appears shortly after the first sale, it rarely creates the same excitement and the perception of immense rarity wanes.

Is it time to avoid grail cards?

Not so fast. Looking for rare grails in a down sports card market is actually a great idea. But, follow these principles:

- Purchase within your financial means

- Buy only cards you believe in

- Intend to hold the card until there is a shift in the player’s market or overall card market

Here are two recent examples where buying grails and selling them in an 18 month window worked:

Why did these two work out? Two major reasons:

- They were held for ~1.5 years and enough “demand” was built up in that amount of time.

- They were bought when each players’ high-end market wasn’t overinflated and were sold after each players’ market perception increased (a.k.a. market hype on performance). Erling Haaland is on pace to smash the Premier League goal scoring record. Alexander Ovechkin (784 career goals) scored 50 goals last season at age 36 and is legitimately chasing Wayne Gretzky (894) for the most goals in history.

- Ovechkin CL Player Index (6/25/21 – 10/22/22): +53%

SlabStox Bottom Line: When buying rare or grail cards, use sound principles to your strategy.

- Buy within your means

- Consider when you would HAVE to sell before purchasing. Have a strategy.

- Buy with an expectation to hold at least a year or more, but stay alert. If something changes in a players market and the hype machine accelerates, be willing to sell at any time unless it is a card for your PC (personal collection).

Take 2: MLB playoffs – Lessons of Harper vs. Judge

Some of baseball’s best and brightest stars were on display in October. As in all sports, some shine and others fade under the bright lights. No stars had a bigger impact on the month than Bryce Harper and Aaron Judge. Harper impacted the MLB Playoffs for all the right reasons, while Judge started out his month capping off a historic season but ended it in “boos.”

Lessons Learned: Aaron Judge

Judge broke Roger Maris’ 61-year-old American League home run record on 10/4/22. The hype leading to that point reached fever pitch. It’s been a long time since Barry Bonds’ home run chase in 2007, and the aura of breaking a record “tainted” by steroid-era accusations sent Judge’s card market into the stratosphere.

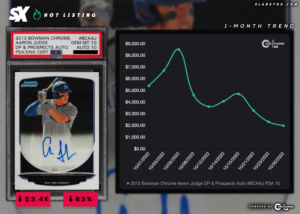

Within the last month, Judge’s 2013 Bowman Chrome 1st Auto PSA 10 lost 63% of its value. Six months ago, you could’ve bought this card for $900. At the peak you could’ve nearly 10x’d your money if you bought it for $900. Even now, you could still net ~120% ROI. The lesson here for card collectors: Always sell on HUGE hype, don’t buy.

In his 38 postseason plate appearances, he hit .138 with 3 RBI, 15 strikeouts and 0 home runs. That clunker of a performance cratered his mythical season, with the last October sale coming in at $1,980 (10/30/22). This graph should be used as a lesson for future record-chasers, any sport, any time.

Return to Glory: Bryce Harper

They say the postseason is a brand new season and Harper clearly took that to heart. By all measures he had a disappointing season (largely due to injuries) compared to his 2021 NL MVP performance. However, he turned that around in the postseason with the Phillies squeaking in as a wildcard team that took down the St. Louis Cardinals, the defending World Series Champions Atlanta Braves and the San Diego Padres. In the 11 games prior to the World Series, Harper had a slash line (AVG/OBP/SLG) of .421/.450/.895.

Setting those kinds of records and being the driving force behind the Phillies making it back to the postseason for the first time in 11 years and the World Series in 13 years has ignited Harper’s card market. His 2011 Bowman Chrome 1st Auto BGS 9.5, like most of his cards, increased 39% over the last month. While it’s possible this card could go higher if Harper and the Phillies do damage in the World Series, and potentially win it, there could be a step drop off if they don’t. There likely will be a drop in the off-season regardless of the World Series outcome.

The hype had never been greater for Judge and yet the predictable price drop came. The hype for Harper has currently never been greater. This is seen as the culmination of what Sports Illustrated started 14 years ago when they put Harper on the cover as a 16-year-old wunderkind.

SlabStox Flash Quiz: Is Bryce Harper a buy or sell? (Reread Take 2 for the answer).

Take 3: Basketball and hockey are BACK

Game on for basketball and hockey. The early season excitement can lead to overreactions on both sides of the coin. Players that start HOT see quick gains. Players that don’t meet expectations can drop like a rock. This is what we’ve learned so far early in the new seasons:

Let’s start with Basketball: The start of the season has not been kind to some of the teams projected in the preseason to be top-10 by oddsmakers (via Basketball Reference). We’re talking about the Brooklyn Nets, Philadelphia 76ers and Los Angeles Lakers. Combined these teams amassed a 7-14 record in October. It’s still early and there is plenty of time for any of these teams to turn it around. But in the card market, individual performances, and even team performances drive prices.

Who are we watching? The Big 3 in the MVP hunt is clear, but there will be some outside challengers (like Donovan Mitchell). They all opened this season with sensational performances: Luka Doncic, Giannas Antetokounmpo and Ja Morant. Here’s a look at some of their card sales for the month of October. Up or down, their performances on the court have been off the charts.

Who is dropping? Much like last season, the names are familiar: James Harden, Ben Simmons and Anthony Davis. James Harden started the season hot, but the production dropped off significantly and so has his card values. Simmons has been abysmal on the Nets, averaging 6 PPG and not being effective enough in other facets of the game. Anthony Davis is putting up solid numbers on the surface (24 PPG/11 RPG), but his jump shooting is still among the worst as he’s hitting only 18% of his three pointers. That’s the exact same percentage he shot in the 40 games he played last year. In the end, as long as their teams underperform, so will their cards.

Budget Risers. Three big “wins” for budget buyers lie in top statistical performers that don’t have the “superstar” tag.

- Caris LeVert—scored 41 points in an OT win against the Celtics

- Keldon Johnson—averaging 24 PPG on 44% 3PT shooting as the #1 option on a surprising 5-2 Spurs team (preseason was tied for the worst odds to win the NBA Finals)

- Anfernee Simons—making nearly 4 threes a game as Damian Lillard’s co-star, helping the Blazers get off to a 5-1 best of the West start.

And now to the ice: Let’s pick up where we left off a season ago. Some of the hot names last season continue to dominate.

- Can’t be ignored—Connor McDavid: He’s off to a blazing start for the Oilers this season, leading the NHL in points (18) and goals (9). But really… who’s surprised?

- Wingman—Leon Draisaitl: McDavid’s teammate and tied for second in points with 16.

- The other guy—David Pastrnak: tied with Draisaitl and Panarin in points (16) and is powering the Boston Bruins to the best record in the NHL (8-1).

SlabStox bottom line: If you’re happy with the profit available, sell your cards of players like Caris LeVert when you can. Early season excitement is rarely seen again until a player is proving it in the playoffs.

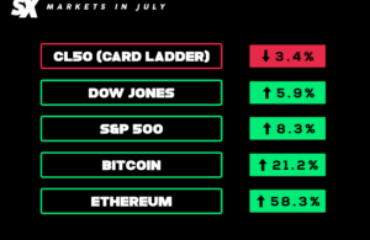

Take 4: Category Reshuffle?

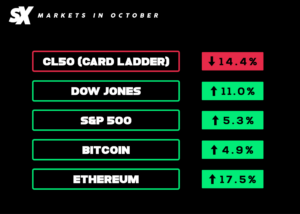

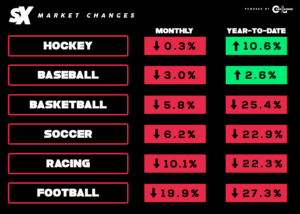

As always, we like to step back and look at the big picture in our Monthly Card Market Report. Here is a sports card index (CL50 provided by Card Ladder) compared to other market indexes, and a rundown of the sports card categories for October:

What does this mean? As predicted last month, the CL50 often “lags behind” other markets, sometimes by a month or more due to the time it takes for transactions to occur. Last month we wrote: “When we update these numbers after October, there is a good chance we might see some of the [September] stock market drops take effect in the card market.” What we saw play out proved our hypothesis.

Diving deeper into the individual sports card categories:

- Hockey moment: It’s happening. Hockey spiked prior to the season and some outstanding individual performances by favorites in the NHL led to the best category performance of October, albeit negative overall.

- Football drops. The Football category peaked on 2/20/22, and has steadily declined. The biggest decline of the year was in October after the close of high-end auctions with early season football excitement evaporating. (See Take 1)

- Basketball and Soccer. We’re far enough into the year to know the categories have taken big hits—20% declines year to date. Overall, October’s NBA opener and the anticipation of November’s World Cup kept these categories from the bottom of the list.

- Racing. As a category, Racing has been falling in 2022 with the F1 Driver and Constructors Championships being decided and dominated by Max Verstappen and Team Red Bull. NASCAR caught the most attention with last weekend’s heart-stopping, barrier-riding, video-game move finish from Ross Chastain, earning him the third spot in next weekend’s NASCAR Championship in Phoenix. Will we see some of that excitement spill over into the card market?

Take 5: Who’s Hot, Who’s Not

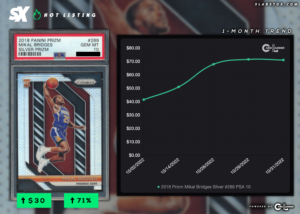

- While it’s only six games, Bridges is averaging career highs across the board. 15.3 PPG, 5.8 RPG and shooting 63% from the field. Expect the FG% to regress a bit as time goes on, but it’s a hot start for Bridges and the Suns (5-1).

- Lamar Jackson in September: 12 total TD, 2 INT and a 119 passer rating. Lamar Jackson in October: 5 total TD, 4 INT and a 79.4 passer rating. The reason behind the drop off is clear.

Looking Ahead:

With November here, there’s a lot to be excited about. For soccer collectors, 2022 Prizm World Cup releases just in time (11/9) for the start of the World Cup (11/20). For baseball collectors, 2022 Bowman Chrome hits shelves at the end of the month. Make sure to view the full product release calendar at the end of this report to see which high-end basketball sets are dropping as well!

Sports Card Shows Worth Checking Out

Nov 3-6:

- (Nov. 3-6) Dallas Card Show, Allen, TX

- (Nov. 5) Hartville Marketplace Sports Card Show, Hartville, OH

- (Nov. 5) Scottsboro Sports Cards & Memorabilia Show, Scottsboro, AL

- (Nov. 5) Twin Cities Sports Collectors Club Sports Card Show, Bloomington, MN

- (Nov. 6) Garfield Cards & Collectibles Show, Garfield, NJ

Nov. 12-13

- (Nov. 12-13) Columbus Sports Card Show, Hilliard, OH

- (Nov. 12) Kokomo Card Show, Kokomo, IN

- (Nov. 13) Des Moines Regional Sports card Show, Des Moines, IA

- (Nov. 13) Plainview Holiday Inn Local Show, Plainview, NY

Nov. 18-20

- (Nov. 19-20) A-Z Cards and Collectibles, Clovis, CA

- (Nov. 19-20) Syracuse Sports Card Show, East Syracuse, NY

- (Nov. 19) Northwest Valley Coin & Card Show, Phoenix, AZ

- (Nov. 19) J&J All Star Sportscards Shows, Louisville, KY

- (Nov. 19) Bat City Sports Card Show, Austin, TX

- (Nov. 19) Mid-South Sports Cards and Collectibles Show, Bartlett, TN

- (Nov. 20) West Palm Beach Sports Cards & Collectibles Show, Greenacres, FL

- (Nov. 20) Greencastle Sports Card & Memorabilia Show, Greencastle, PA

Nov. 25-27

- (Nov. 25-26) Black Friday and Saturday Sports card & TCG Collector’s Show, Salt Lake City, UT

- (Nov. 26) Red Cedar Sports Show, Lansing, MI

- (Nov. 26) North Metro Card Show, Cambridge, MN

- (Nov. 26) Johnson County Fairgrounds Sports Card Show, Iowa City, IA

- (Nov. 27) Primetime Card Show, New Britain, CT

- (Nov. 27) Sports Card & Collectible Show, Wilmington, DE

- (Nov. 27) Albany Sports Card & Memorabilia Show, Albany, NY

November: Important Product Releases

Many product releases have been delayed by manufacturers due to supply chain issues. The release dates below are subject to change by the manufacturer. Dates provided by Cardboard Connection.

Nov. 2:

2022 Panini Origins Football

2020 Star Wars Topps Chrome Black

Nov. 4:

2021-22 Panini One and One Basketball

Nov. 9:

2022 Panini Prizm World Cup

Nov. 10:

2022-23 Upper Deck Series 1 Hockey

Nov. 16:

2021-22 Panini Contenders Optic Basketball

2020-21 Upper Deck The Cup Hockey

Nov. 18:

2022 Topps Allen & Ginter Baseball

2022 Topps Chrome NPB Nippon Professional Baseball

Nov. 23:

2022 Bowman Chrome Baseball

2021-22 Panini Immaculate Collection Basketball

2022 Topps Triple Threads Baseball

2022 Topps Star Wars The Book of Boba Fett

Nov. 25:

2022 Topps Stadium Club Baseball

Nov. 30:

2022 Topps Formula 1 Racing