Slabstox Card Market Report: July 2022

This July monthly trading card market report concluded simultaneously with the 2022 National Sports Collectors Convention in Atlantic City, N.J., and we had a chance to see first hand what so many told us: The trading card industry is alive, vibrant and growing. Here are a few things that back that up:

- An estimated 90,000-plus card collectors poured into the Atlantic City Convention Center during the five-day run. Crowds at The National in Atlantic City surpassed the 2021 show in Chicago.

- With the huge attendance, one thing was noticeable: More women actively trading, selling and collecting than ever.

- Corporate presence was enormous–the biggest ever seen at the NSCC with not only the old standbys (Topps, Panini, Dave & Adam’s Card World) but plenty of new additions including experiential card shops (@RoadShowCards), investment and asset platforms (PWCC, Collectors, eBay, Alt) grading companies (PSA, SGC, BGS, CSG) and a big, loud presence by the live-stream selling platform, Whatnot.

- Fresh new trading card categories received a tremendous amount of attention—which doesn’t necessarily line up with some of the category data gathered from online transactions. For example, football and racing could only be described by one word–HOT!

There is plenty more about The National in this report and the overall trading card market. We’ll again drill-down into what’s happening, measure where we are, and look to where the market is heading in the coming months.

Here’s what we’ll cover:

- Take 1: Your Voices from The National: What is the state of the trading card market?

- Take 2: Monthly Market Comparisons

- Take 3: World Cup moment upon us; baseball carries momentum

- Take 4: Modern and Ultra Modern cards level up

- Take 5: Who’s Hot, Who’s Not

- Take 6: The Fanatics Effect: Exclusive interview with Josh Luber

- Final Take: SlabStox view of the current sports card market

Join the SlabStox/CardTalk podcast collab as we break down the full market report scheduled for early August. Stay tuned to social media for updates.

If you want to receive this SlabStox Trading Card Market Report every month, subscribe to SlabStox’s Daily Slab newsletter, delivered to your inbox every morning at 7 a.m. ET.

Besides this report, you’ll get daily card market news, data and charts of trending players, and a whole lot of SlabStox curated top-auction targets to help build your card collection.

5 Hot Takes From the The National and July Trading Card Market

As usual, we’ll dive into the data to get a sense of where the trading card market is at, but we’ll also share some first-hand observations witnessed at The National Sports Collectors Convention in Atlantic City, N.J., July 27-31. The findings are based on industry feedback and sales data provided by Card Ladder, our source for card market data and insights.

Two time periods are used in this report for comparison purposes:

- Monthly (7/1/22 – 7/31/22)

- Year to Date (1/1/22 – 7/30/22)

DISCLOSURES: All market data in this report is from Card Ladder. Card Ladder is an independent, third-party partner of SlabStox, providing card collectors and investors insights to make informed, up-to-date data-driven decisions. Every investment and trading move involves risk. You should conduct your own research before making a decision.

TAKEAWAY 1: The trading card market is expanding and growing.

We spoke with so many amazing people at The National and they shared their takes on the NCSS 2022 and the current state and trend of the overall trading card market:

“The hobby’s not dead. The first thing that sticks out is the hobby is alive and well.”

-

- Ryan Bannister, @RBICru7, St. Peters, MO

“I felt like in years past everyone was chasing the same big names. But this year I had so many people come and they’re looking for their players, and I think the collector market is really strong.”

-

- Joy Kadowaki, @jerners.sports.cards, Dayton, OH

“I feel like every other person said this is their first National.”

-

- Ryan Johnson, @cardcollector2, Columbus, OH

“We have a lot more people in the market than we did two years ago for sure. If you look purely off of just an exchange rate, and we all have our own ways to figure out what a nice index is, I think we’re down probably 30% from the peak, but I’ve seen in the last month a trend back up.”

-

- Dan Dearing, ABC Sportscards, Jacksonville, FL

“Just because the market softens, as it does every year at this time, that doesn’t mean the sky is falling. Buys are more strategic. Sales are more strategic. A lot of savvy people doing savvy business. That doesn’t mean the market is down. I think it means it’s as healthy as it has ever been.”

-

- Tracy Hackler, @roadshowcards, Highland Village, TX

CTA: Watch: YOUR State of the Sports Card Market Takes from The National #NSCC22

SlabStox Bottom Line

- Based on the location of The National, market dynamics and the current economic environment, we were expecting a retraction from the 2022 National in Chicago. It didn’t only maintain its buzz and attendance from last year, but it actually GREW in both areas. This was by far the busiest we’ve ever seen the biggest card show in the world. That further builds the case of sports cards being around for the long haul, regardless of what the day-to-day or month-to-month indexes say. The passion is REAL.

TAKEAWAY 2: The numbers tell us trading card indexes lagging; poised for a bounce

Down go gas prices, up goes consumer confidence, which is a good sign for the card market. That means more cash in consumers’ wallets. Recent surveys have indicated consumers are hoarding cash more than they have in years, and cash was king when striking the best deals at The National (especially due to little cell service or accessible wifi for most attendees).

While inflation continues to weigh in on the economy, July was a good month for many comparable indexes:

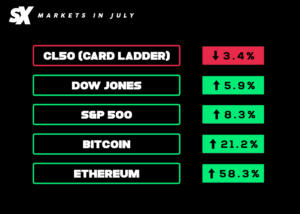

- The CL50 (a representative Card Ladder index of 50 highly transacted cards to represent the overall market) decreased 3.4% in July. With the start of football, basketball, soccer and hockey seasons just around the corner and an exciting Home Run Derby to kick off the second half of the baseball season, the downward trading card trend has slowed to a more stable trendline.

- Stocks had a July run—the S&P 500 and Dow were both positive in July.

- Crypto bounce—Etherum and Bitcoin both had double-digit July rebounds.

- The biggest drag—inflation. The Fed raised the interest rate for the second consecutive time by .75 of a percentage point to fight inflation. However, inflation eased a bit for July, as the Consumer Price Index came in at 8.5% (1-year change), lower than the previous month (9.1%)

With continued uncertainty in the air, where does that leave the trading card market as consumers navigate a choppy economy?

“Typically the card market lags all other markets,” said Aaron Nowak, SlabStox Founder & CEO. “Other indexes are up in July, yet the card indexes overall are still showing red. It takes a lot longer to sell physical assets (like cards) than commodities (like stocks and cryptocurrency). If the other markets are showing green in July, it could be a good sign for the next couple months in the card market. Especially with the pull back before The National and the return of football, basketball, hockey and the World Cup.”

30-Day Card Market Performance: The overall card market performance during the past 30-days shows the decline stabilizing, which since the beginning of the year has been dropping (YTD). The CL50 decreased 3.4% since the start of July, significantly lower than the June trend: down 7.53%.

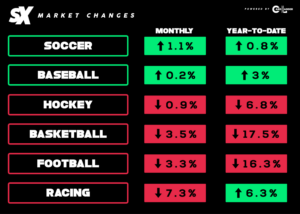

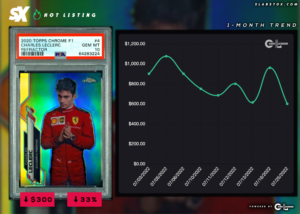

Many of the card categories in this report (see Takeaway 3) are following that same trend. Nearly all categories decreased at a slower rate than June, with the exception of baseball, racing and hockey (which increased last month). In fact, the racing category, fueled by the popularity of Topps Formula 1 releases in 2020, was the biggest category loser in July dropping 7.3%, while it remains the biggest category performer YTD with an 6.3% gain. This is a category to watch, but there is no doubt sales were strong in Atlantic City, with a full trade night dedicated to Formula 1.

Some of the best performing cards in the month of July from the CL50 include the Oscar Robertson 1961 Fleer RC PSA 6 (+43%), Hank Aaron 1954 Topps RC PSA 5 (+27%) and Kevin Durant 2007 Topps Chrome RC PSA 10 (+24%). If you remember, the Robertson PSA 6 was actually one of the biggest fallers in last month’s report. That right there is an example of why “eye appeal” matters so much in vintage cards. Prices of cards with the same grade can fluctuate 20-30% strictly because of how it looks.

Noteworthy high-end sales from July include 1/1 rookie cards of some of the most coveted young players in their respective sports. Wander Franco’s 2022 Topps Series Platinum RC 1/1 PSA 9 sold for $44,424 via Goldin Auctions, a price that many expected to be much higher if it was graded and auctioned right after it was pulled at Walgreens in April. The other is Trae Young’s 2018 Prizm Black RC Auto 1/1 BGS 9.5/10. While it’s not as coveted as the non-auto version, it’s still a key, high-end Trae rookie. It sold for $90,000 in the July PWCC Premier Auction, but it sold for $276,000 four months prior. Not the time to try to flip a high-end 1/1, that’s for sure. Normally cards like those take years to mature.

SlabStox Bottom Line

- In the world of sports cards, there are two times in a player’s career where you would ideally NOT want to sell: during injury or during a slump. In the case of the Wander Franco 2022 Topps Series 1 Platinum RC 1/1 PSA 9, the seller managed to hit both of those times in one selling window. This created one of the most shocking sales we’ve seen in recent memory and potentially a major bargain for the new owner.

- Buying a multi-hundred thousand dollar 1/1 card of a young player just to sell a few months later (in the midst of a recession) is a move that probably shouldn’t be in your playbook.

TAKEAWAY 3: World Cup moment upon us; baseball carries momentum

For two-plus years, card collectors gravitated to the soccer card market with high expectations for the 2022 FIFA World Cup in Qatar. Mbappé and Haaland joined Messi and Ronaldo as recognizable names on the pitch during that time period, and are both seen as the successors to two of the greatest to ever play. July showed renewed interest in a sagging soccer market, which dropped 3% in June, but the script flipped and it increased 1% in July. It will be fun to watch this trend as we build toward the World Cup and which players will stand out with top performances in November. When it comes to standouts, we can guarantee one thing; it won’t be Haaland, as Norway did not qualify for the World Cup.

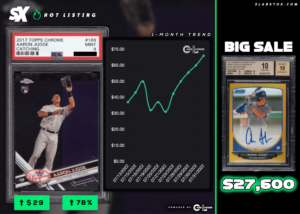

Likewise, baseball returns to another market report (highlighted in June) and continues to at least maintain value even through the All-Star break. An electric mid-July Home Run Derby between two of the game’s youngest superstars—the new Padre Juan Soto (winner) and Mariner Julio Rodriguez (81 Derby HRs)—and the Yankees return as a powerhouse led by Aaron Judge’s chase for 60 home runs is keeping baseball interest high, even during the dog days of summer. If the National Pastime remains exciting going into the pennant race, 2022 could be a banner year for the sport that brought us the sports card hobby in the first place. (See SlabStox Bottom Line on the baseball market below.)

Soccer: Past and Present Drive Market

Pelé. Messi. Mbappé. The past and the present. These are three names that will be searched for in the soccer card market for decades to come. Pelé and Messi are already mentioned in the GOAT conversion, and with Mbappé being an impact player and winning a World Cup at 19-years-old, he very well could get there at some point. Three cards that helped drive a 1% increase in the soccer card market is the Pelé 1958 Editora Aquarela Blue PSA 1 (+28%), Lionel Messi 2005 Panini Champions of Europe Sticker PSA 9 (+56%) and Kylian Mbappé 2021 Donruss Road to Qatar Kaboom! PSA 9 (+32%).

Baseball: New Era of Superstars Emerge

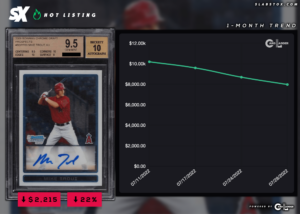

Julio Rodriguez and Juan Soto gave us a show to remember at the 2022 Home Run Derby. Shortly after, Juan Soto landed on his new team, the San Diego Padres, and will once again be showcasing his talent on a winning ball club. These two players alone have held up the baseball card market, but let’s not forget about Aaron Judge who is vying to be the first player to hit 60 bombs since the steroid era. Our baseball card showcase for this month includes the Julio Rodriguez 2019 Bowman Chrome Speckle Auto /299 PSA 10 (+34%), the Juan Soto 2016 Bowman Chrome Refractor Auto /499 BGS 9.5/10 (+71%) and the Aaron Judge 2013 Bowman Chrome 1st Base PSA 10 (+32%).

SlabStox Bottom Line

- No matter if it’s vintage, international stickers or modern inserts, if you have the right soccer player there’s potential in the market right now and through the end of the World Cup. But be careful. Holding too long on certain players that fizzle out will potentially lead to big losses. Buckle up footy fans!

- Selling while profit is there is important, but sometimes holding long-term is the right thing to do. Depending on your purchase price of each card, selling players like Julio, Soto and Judge when they’re high pays off. Other times, you miss out on more profit down the road (see Judge trend in Takeaway 5).

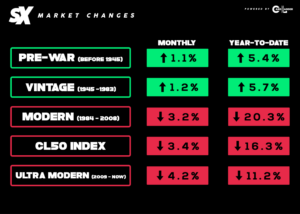

TAKEAWAY 4: Modern and Ultra Modern cards level up

While the Pre-War and Vintage indexes showed green this month, we must remember it’s much harder to show a 1 to 1 comparison for vintage card grades versus modern card grades. Two of the top trending vintage cards in July were this Jackie Robinson 1949 Bowman PSA 1 (+241%) and Willie Mays 1953 Topps PSA 1 (+175%).

For the Jackie Robinson PSA 1, it increased nearly $2,000 in the span of three days. The reason? The one that sold for $732 was absolutely destroyed (see above). The more recent sale of $2,500 was still damaged, but not nearly as bad. As for the Willie Mays, the most recent sale of $2,310 was nearly three times more than the other three sales in July. The $2,310 sale was given a PWCC-S designation, meaning PWCC considers it to be a top 5% condition copy for a PSA 1 of that given 1953 Mays card.

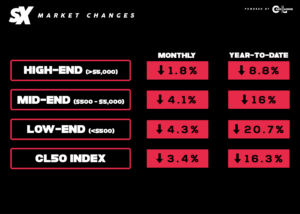

While the High-End index was the most stable in July, it underestimates some of the drops certain cards experienced. Within one month of time, Jayson Tatum’s 2017 National Treasures FOTL RPA /15 BGS 9.5 decreased 47% in value, dropping from $43,200 to $22,800. It’s worth pointing out the $43K sale had a two-color patch and $23K had a one-color patch, but that doesn’t fully explain a $20K difference in price. Two other high-end cards dropping in July were the Luka Doncic 2018 Optic Contenders Red RC Auto /149 BGS 9.5/10 (-26%), with the most recent sale dipping to $5,100, and the Giannis Antetokounmpo 2013 Prizm Red RC BGS 9.5 (-25%), with the most recent sale dipping to $6,005.

SlabStox Bottom Line

- The steep decline in Ultra-Modern subdued a tad, as last month that category dropped 10%, but this month only 4%.

- Eye appeal is exponentially more important in the vintage market than the modern market, but expect those principles to become more prominent in the modern card market now and in the future as competition between grading companies ramps up.

- What do all of the high-end droppers have in common? They are all superstar NBA players that recently got eliminated from the playoffs and are now in their offseason. Be careful buying in the playoffs next season.

TAKEAWAY 5: Winners & Losers

Once again, performance and sports news are one of the biggest drivers of the market. Whether it’s Aaron Judge chasing 60 home runs or Kyler Murray signing a mega-extension, real world events matter in the sports card market.

WINNERS

1. Aaron Judge

2. Anthony Davis

3. Kyler Murray

LOSERS

1. Charles Leclerc

2. Mike Trout

3. Nikola Jokic

TAKEAWAY 6: The National and Looking Forward

As always, we’re going to wrap up this month’s market report with a look ahead.

1. The Fanatics Effect – Part II

SlabStox Aaron had a one-on-one conversation with Josh Luber, Chief Vision Officer of Fanatics Collectibles including Topps, Bowman and zerocool card brands. What effect will Fanatics’ entry into the collectible card market have going forward? It was a question that came up in our first market report and we were determined to get some insight. We aren’t going to make predictions, but here’s what Luber had to say:

-

- 00:00 – What is the Fanatics Effect?

- 00:26 – When will Fanatics make an impact on Topps product releases?

- 1:38 – With basketball and football licenses coming, how long will it be before we see Fanatics’ touch on the products?

- 2:07 – Will the blind-Dutch auction model work its way into Topps sports card releases?

- 3:27 – Will the blind-Dutch auction be the only method to get zerocool cards?

- 4:07 – How broad is the definition of culture cards?

- 4:44 – How long will it take the card market supply chain to catch up?

- 5:32 – Delayed releases annoy me as a collector.

- 6:47 – Are Topps, Panini or Bowman Chrome dead?

- 7:38 – What can collectors expect from Fanatics two years down the road?

- 8:48 – Will Fanatics grade cards? How streamlined will the experience be?

- 9:53 – What should the local card shops expect from Fanatics?

- 11:33 – How hard is Fanatics going to push on global expansion?

- 13:03 – Josh Luber’s Passion Project: Culture, Commerce and Finance

- 13:34 – When should we expect the next Fanatics product releases?

Watch the Full Exclusive Interview: The Fanatics Effect with Josh Luber

2. August Bounce. August will be a critical month for watching market movement. There is a consensus that card transactions slow the month prior to The National. In addition, we mentioned earlier in the report, the process of selling card assets slows the card market as opposed to other indexes that all had a strong July. So, here are a few questions to think about:

- Atlantic City was a buyers market. There were more sellers than buyers making it an amazing time to find deals. Will some of those show up as flips in the next few months? Will that give more leverage to buyers?

- Will the overall economy improve? The July Consumer Price Index eased in July, coming in at 8.5%. Inflation is still at an high level historically, but lower than the previous month’s 9.1%. Will a healthier economy invigorate alternative assets?

- Will collectors shifting to the vintage market find out it’s too late? Is the August play to bottom feed on down markets? Feedback from The National is that the $100-$500 market was amazing for sellers—will that carry over into the online marketplaces?

3. Trading Card Shows Worth Checking Out

August 5-6:

Fort Lauderdale Card Show, Fort Lauderdale, FL

August 6-7:

A-Z Cards and Collectibles, Clovis, CA

August 13-14:

Silicon Valley Trading Card Show, San Jose, CA

Bay Area Sports Card Show, Clearwater, FL

August 26-27:

Tampa Bay Sports Card Show, Tampa, FL

August 26 -28:

All Cards Weekend 2022, Denver, CO

August: Important Product Releases

Many product releases have been delayed by manufacturers due to supply chain issues. The release dates below are subject to change by the manufacturer. Dates provided by Cardboard Connection.

August 3:

2021 Panini Obsidian Basketball

August 10:

2021 Upper Deck Black Diamond Hockey

2021 Panini Select Football

2021 Topps Finest UEFA Soccer

August 17:

2022 Bowman Sterling Baseball

2021 Topps Inception OTE Basketball

2021 Topps Finest Bundesliga Soccer

August 24:

2022 Topps Clearly Authentic Baseball

2022 Panini Gold Standard Football

August 26:

2022 Panini Chronicles UFC

August 31:

2022 Topps Five Star Baseball

2021 Panini Donruss Optic Basketball

2021 Topps Tier One Bundesliga

SlabStox Final Take

Let’s start with the bad news: The overall July ’22 card market lagged behind other market indicators that enjoyed a Christmas in July surge (see Takeaway 1).

The good news: The downward slide in the CL50 has leveled considerably in July (-3.4%) compared to June (-7.5%). The card market traditionally lags other indicators, as it is a slower moving market. If that holds true, will next month yield a positive trend for card collectors?

There were a lot of variables impacting the July card market:

- On the Macro: The consumer price index came in at 8.5% in July. There’s no way to spin this besides consumer dollars are stretched to the limit.

- On the Micro: The National Sports Collectors Convention in Atlantic City, NJ, brought energy and enthusiasm into the card market at the right time—pre-football, basketball and hockey seasons. Will that set the tone for the next few months?