SlabStox Card Market Report: June 2022

A lot has changed since SlabStox began tracking the sports card market in 2018. And for a lot of you, we’re sure the market has evolved since you started collecting. Whether you’re new to the hobby or a long-time collector, you know things are moving fast.

SlabStox Monthly Card Market Report is the first of its kind—we’re going to break down key factors in the card market each month so you get a sense of what’s next. It’s for anyone who wants to understand the forces impacting card-buying and selling decisions.

Each month we’ll:

- Present data and our takeaways that illustrate the current state of the card industry

- Co-host a live podcast with @CardTalkPod breaking down the report and debating its findings

- Encourage you to learn, comment on, debate and share it out with your card community

The SlabStox/CardTalk “State of the Card Market” podcast premieres July 2. YouTube will notify you when it drops. Join us–it’s guaranteed to be fun and educational.

If you want to get notified when the SlabStox Monthly Card Market Report gets published, subscribe to SlabStox’s Daily Slab newsletter, delivered to your inbox every morning at 7 a.m. ET. Besides the monthly report, you’ll get daily card market news, card-sales data on trending players, and a whole lot of SlabStox curated top-auction targets.

Enjoy, learn and share. Give us feedback–it matters and will make each monthly report even better.

June 2022: 5 Hot Takes On Today’s Card Market

How is the card market performing in a down economy? Which card categories are hot, and which are not? Whose recent performances are driving their card values up or down? What should card collectors be thinking about next?

Here’s our takes on the current state of the card market, based on data provided by Card Ladder.

Two time periods are used in this first report to get a sense for the overall:

- Monthly (6/1/22 – 6/30/22)

- Year to Date (1/1/22 – 6/30/22)

DISCLOSURES: All market data in this report is from Card Ladder. Card Ladder is a partner of SlabStox, but operates independently, providing card collectors and investors insights to make informed, up-to-date data-driven decisions. Every investment and trading move involves risk. You should conduct your own research before making a decision.

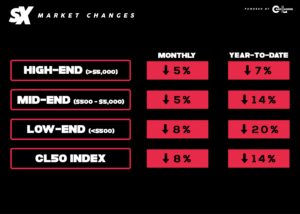

TAKEAWAY 1: Sports card index down, but outperforming the “bear market” and “crypto winter”

There has been a lot written and reported on the current state of the U.S. economy:

- Record gas and energy prices

- Inflationary growth that hasn’t been seen for multiple decades

- A shift from a “bull” to a “real bear” stock market

- Rumblings of an oncoming recession

- Run-up of cryptocurrency and NFTs, and a prick of the bubble

So where does that leave the sports card market?

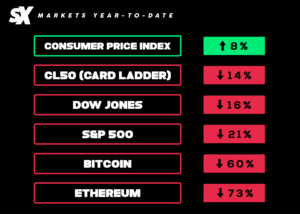

Card Market Year-to-Date

According to Chris McGill, founder of Card Ladder, a data platform that tracks verified card transactions from 14 marketplaces (eBay, PWCC, etc.), sports cards have been fairly flat over the last year — but down 8% in June and it has dipped 13.76% year-to-date.

Card Ladder built the CL50 Index, an index of 50 highly transacted cards, to represent the overall market. Some of the cards included are the Wayne Gretzky 1979 O-Pee-Chee RC PSA 8, LeBron James 2003 Topps Chrome Base RC PSA 10, Patrick Mahomes 2017 Prizm Silver RC PSA 10 and the Hank Aaron 1954 Topps RC PSA 5. Here’s a look at how it changed over the last two years.

From January 2021 until March 2021, the CL50 Index doubled in value — from 16,120 (1/3/21) to 33,200 (3/7/21) in just two months. It didn’t take long to correct in value. From March to June 2021, the CL50 dropped back to 16,800 (6/27/21).

“The CL50 Index hasn’t moved much over the last year,” McGill says. “The card market had a mania in 2021–a bull run unlike ever seen before. All those gains were wiped away.

“The bear market we’re seeing in other sectors, whether it is Bitcoin or the S&P taking a hit, the card market had about 14 months ago,” he explains. “What I see happening in other markets I remember watching it real-time in the card market a while ago.”

Here’s how the CL50 Index performed to other standard market indicators:

MARKETS YEAR TO DATE (1/1/22 – 6/30/22)

Andy Albert, owner of Indy Card Exchange, says boots-on-the-ground metrics prove there is still energy in the card market.

“The optimism is still there and holding something tangible to collect or invest in will never go away,” Albert says, who recently organized the “Midwest Monster” card show that attracted nearly 4,000 card collectors to its first show in Indianapolis, June 17-18.

“At our shop, there hasn’t been any dip or downturn in the number of people walking in and out,” he adds. “Obviously, people are spending money more wisely. The market is still strong but people are more selective in what they are buying.”

June 2022: 30-Day Performance

When comparing the June CL50 trend to the other months so far in 2022, it comes as the second worst performing month (-8.07%), right behind May (-8.71%).

The cards in the CL50 that have gotten hit the hardest this month are the Mike Trout 2011 Topps RC PSA 10 (-20%), Charizard 1999 Pokémon 1st Edition Holo PSA 9 (-20%) and the Oscar Robertson 1961 Fleer RC PSA 6 (-20%).

Buying the “surefire thing” with Patrick Mahomes and Luka Doncic was praised for years, but rubber hit the road for two of their high-end cards in June, as both of them experienced a card that lost ~$500,000 since the last time it sold. Mahomes’ 2017 National Treasures Gold RC Patch Auto /10 BGS 9.5 sold for $1,080,000 on 9/18/21, but recently sold for $480,000 on 6/16/22. Luka’s 2018 National Treasures Emerald RC Patch Auto /5 BGS 9 sold for $1,000,000 on 8/2/21, but recently sold for $504,000 on 6/16/22.

SlabStox Bottom Line

- Playoff misses. While -8% for the CL50 and -20% for the Mike Trout PSA 10 is a substantial monthly slide, it does understate how bad June has been for some of the cards in the market. Buying cards of players that rose in price due to playing at their peak performance proved to be an incredibly bad investment, as Jayson Tatum’s 2017 Prizm Blue RC /199 BGS 9.5 decreased 45% and Jordan Poole’s 2019 Prizm Fast Break Blue /175 RC PSA 10 decreased 52%.

- The stalled flip. Buying cards to flip within a 30-day period was next to impossible in June, as your only luck would have come with capitalizing on a hot playoff flip.

- What we’re feeling. People are selling if they:

-

- Need money for living expenses/savings

- Are substantially in the green over the past three years or more

- Want cash flow to make stronger plays at the The National

- Don’t believe in a certain card long-term (generally base cards)

- Want to re-invest into a different “down” card.

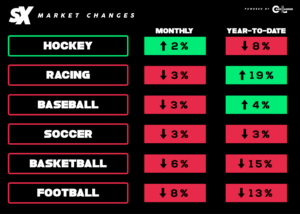

TAKEAWAY 2: Baseball’s upswing + F1 surge lead card market

While overall the card market is down this year, there are some standout bright spots—hockey up 2% in June with a Stanley Cup bounce, while baseball and racing have increased since the start of the year.

CARD MARKET COMPARISONS

MONTH (6/1/22 – 6/30/22) / YEAR-TO-DATE (1/1/22 – 6/30/22)

Baseball, while down 3% in June, has increased 3.5% for the year, outpacing other major sports—football (-8.28 / -13.40%) and basketball (-6.15% / -15.13%).

Racing, fueled by the exponential growth of the F1 card market coming off the success of the first 2020 Topps Chrome F1 release last year, has grown the most this year (+19.22%). For June, F1 sales have leveled off, trending down a hair (-2.63%) as the season is well underway, with one team dominating (Red Bull).

“2022 feels like baseball’s turn in the spotlight,” McGill says. “2020 was the year of basketball, 2021 football exploded on the heels of Brady and the Bucs Championship. A lot of people seem to now be interested in baseball.”

Albert’s perspective is that the market, whether up or down, is largely driven by the strength of rookie classes in product sets.

“Baseball is up because of how strong the rookie class is,” he says. “People are looking into baseball because they can buy affordable products and can get good rookie cards. Bobby Witt Jr. and Julio Rodriguez—those guys are studs and with huge upside.

“Quarterbacks dominate the (football) marketplace,” Albert adds. “People who held and invested in the QB class of 2020 are very happy.”

Some specific category highlights from June:

Racing: All-Time High Sales for MULTIPLE drivers in June

Each of these drivers converted an all-time high sale for a card.

- Max Verstappen

-

- 2020 Topps Chrome Red Auto /5 PSA 9/10 – $90,000 on 6/25/22 via Goldin

- Mick Schumacher

-

- 2021 Topps Chrome Superfractor RC Auto 1/1 PSA 10/10 – $39,600 on 6/25/22 via Goldin

- Guanyu Zhou

-

- 2021 Topps Chrome Superfractor Future Stars 1/1 PSA 8 – $18,000 on 6/4/22 via Goldin

- Team Logo: Mercedes

-

- 2020 Topps Chrome Mercedes Superfractor 1/1 PSA 7 – $13,200 on 6/25/22 via Goldin

Albert’s perspective is that the market, whether up or down, is largely driven by the strength of rookie classes in product sets.

“Baseball is up because of how strong the rookie class is,” he says. “People are looking into baseball because they can buy affordable products and can get good rookie cards. Bobby Witt Jr. and Julio Rodriguez—those guys are studs and with huge upside.

“Quarterbacks dominate the (football) marketplace,” Albert adds. “People who held and invested in the QB class of 2020 are very happy.”

Some specific category highlights from June:

Racing: All-Time High Sales for MULTIPLE drivers in June

Each of these drivers converted an all-time high sale for a card.

- Max Verstappen

-

- 2020 Topps Chrome Red Auto /5 PSA 9/10 – $90,000 on 6/25/22 via Goldin

- Mick Schumacher

-

- 2021 Topps Chrome Superfractor RC Auto 1/1 PSA 10/10 – $39,600 on 6/25/22 via Goldin

- Guanyu Zhou

-

- 2021 Topps Chrome Superfractor Future Stars 1/1 PSA 8 – $18,000 on 6/4/22 via Goldin

- Team Logo: Mercedes

-

- 2020 Topps Chrome Mercedes Superfractor 1/1 PSA 7 – $13,200 on 6/25/22 via Goldin

SlabStox Bottom Line

- F1 benchmarks. Not only was the Topps Chrome Red Auto /5 the most expensive Max card ever, but it also was the most expensive Topps Chrome F1 Auto to ever sell. While Mick Schumacher’s sale was his “rookie,” he actually had a 2020 Topps Chrome Superfractor Auto 1/1 which was an F2 Future Stars card. The 2021 Guanyu Zhou is in the same boat as the Mick, except Zhou’s card isn’t a rookie, it’s his 2nd F2 Future Stars card. That fact combined with the sale price ($18,000) makes for a head scratcher. The Mercedes Superfractor was the first F1 Team Logo card to cross 5-figures, with the next closest sale being the Mercedes Sapphire Red /5 PSA 10 ($9,000 on 5/21/22).

- Baseball slides. Bowman Chrome took a big hit from the peak prices, but not everything can go up forever, right? Ohtani’s Red decreased $72,000 (-23%) since the previous sale on 12/18/21. It was the exact same card (#3/5). Soto’s Red decreased $129,060 (-47%) since the previous sale 10/25/21. It was also the exact same card, and funny enough, matches the serial number on the Ohtani (#3/5).

- Prospect prospectus. Bowman Chrome Red autos of Christian Hernandez ($58,200) and Marcelo Mayer ($54,000) sold for huge price tags. Both have only played in A-ball or below, and neither have put up impressive numbers. There were multiple bidders willing to pay $50K-plus for their red autos. Remember, just because a player is young and has tools doesn’t mean he is destined to be a star. This is a risky investment, but one that could pay off big.

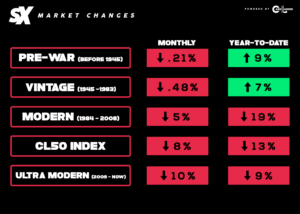

TAKEAWAY 3: Like gold, vintage cards strong in a down market

CARD CATEGORY COMPARISONS

MONTH (6/1/22 – 6/30/22) / YEAR-TO-DATE (1/1/22 – 6/30/22)

New to Card Ladder are Pre-war Vintage, Vintage, Modern and Ultra-Modern card indexes. What do these new categories tell us about the market?

- Vintage cards are holding up in a down market

- Vintage and Pre-War Vintage cards are significantly outperforming the CL50 Index

- Modern cards overall have slipped dramatically in 2022 (-18.76%)

- Ultra Modern cards have dropped double-digits in June due to a correction (-10.17%)

Vintage runs hot

Why are Vintage and Pre-War Vintage cards holding strong? One hypothesis is the icons of this era are historically proven out and their cards are a limited resource. This makes vintage cards less risky in collectors’ eyes. Does this equate to gold, which typically runs hot during market downturns?

“The way I look at it, the card market consists of three types of buyers—collectors, investors and gamblers,” Albert explains. “Vintage appeals to two of those three buckets—collectors and investors—because it creates stability. Twenty-five years ago the vintage market was based on emotions, but now with grading it is quantifiable and vintage is constant and stable over time.”

He also thinks it goes deeper. Vintage cards connect on an emotional level with collectors.

“The younger generation can see the impact these players had,” Albert adds. “Jackie Robinson–you can watch on YouTube and see the impact he made. He’s an exception in every way because of the fact he broke the color barrier and is so well loved across every generation. I never see that going away.”

Some trending vintage cards in June include:

- 1955 Bowman Mickey Mantle PSA 4.5

- 1981 O-Pee-Chee Paul Coffey PSA 8

- 1957 Topps Bill Russell PSA 5

*Note: Vintage cards of the same grade can often vary in final sale price. Eye appeal is extremely important, and just because one grade sells for a certain amount does not mean the next sale of the same grade will match. That variance could contribute to certain cards rising in price quickly within one month.

A Deeper Look at Modern and Ultra Modern

CARD CATEGORY COMPARISONS

MONTH (6/1/22 – 6/30/22) / YEAR-TO-DATE (1/1/22 – 6/30/22)

Surface numbers don’t always tell the full story of what is happening in the current market. While Modern and Ultra-Modern cards are taking a hit overall, it isn’t indicative of the entire market in these categories.

For example, the Base card market has been wiped out from its peaks. Players like Luka Doncic (-25%), Ronald Acuña Jr (-47%) and Kylian Mbappé (-47%) have all gotten crushed since the start of the year on their extremely high population Base RC PSA 10s. Keep in mind, cards like the Luka Doncic 2018 Prizm Base RC PSA 10 are still nearly triple the price they were three years ago.

Albert says these numbers reflect a market correction that was long overdue.

“There was nowhere to go from a year ago but down,” he says. “It comes back to the local card shops educating people and steering them away from Luka Doncic PSA base rookies and Zion Williamson base cards that were way overpriced.

“People are spending money on the right things now, buying National Treasures, Flawless and low-number Prizm color,” he says. “They’re still spending money—what is dragging those categories down is the standard, everyday flagship stuff. It’s finding its level because it dropped so hard and so fast.”

SlabStox Bottom Line

- Where’s the floor? The Base PSA 10 market still has room to drop. While the Luka Doncic 2018 Prizm Base RC PSA 10 is $333, which could look like a deal from the peak price of $2,000, that same card used to be $40. When they were $40, there weren’t 20,000 PSA 10s flooding the market like there are now. The market is extremely smart compared to two years ago, and the trend will continue on the low supply, sought after brand cards taking all of the market money.

TAKEAWAY 4: Big players, big performances, big rewards (and some misses)

If you follow the Ultra-Modern card market, there’s one rule worth remembering: Performance plays out.

Here are some key players and cards we tracked and reported on in June that are outperforming the market and their competition. Likewise, we’re including some cards that have sputtered—often for the same reason: Underperformance.

Let us know in the comments what cards are your winners and losers in June.

Winners

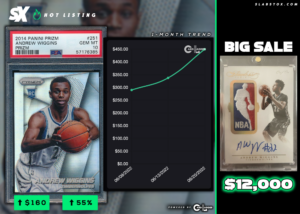

1. Andrew Wiggins

- Nine seasons after being picked No. 1 in the 2014 NBA Draft, Andrew Wiggins has made the most of his shot at redemption. He earned a starting spot on the Western Conference All-Star team (to the dismay of some fans), and in the Finals, he played a key role for the Golden State Warriors, including a team leading 26-point Game 5 on the way to the Warriors fourth title in 8 years. For a player labeled as “lazy” and “lackadaisical” for most of his NBA career, Wiggins put on a playoff show on both ends of the court against some of the best players in the league. Now, he has a ring.

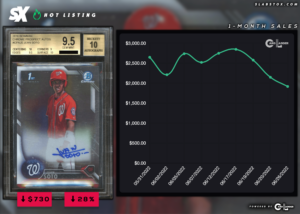

2. Paul Goldschmidt

- Paul Goldschmidt ended May with a Cardinals record that eclipsed some of the best hitters in the game. He finished the month with 23 extra base hits, topping Stan Musial (1954) and Albert Pujols (2003), who each previously held the record with 20. In June, Goldy has continued his hot hitting with a team-leading and career-best slash line of .342/.424/.630 with a 1.054 OPS. Holders of Goldschmidt’s 2011 Topps Update Rookie PSA 10 have been rewarded with his strong performance. It’s increased 12.91% over the last 30 days, with the most recent sale at $175. (6/28/22).

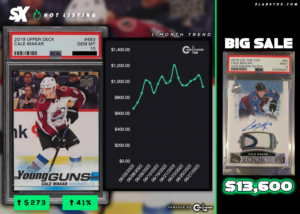

3. Cale Makar

- Colorado Avalanche defenseman Cale Makar has been nothing short of amazing during the Avalanche playoff run. Back when they clinched a spot in the Stanley Cup Finals, he was praised by Wayne Gretzky. “The Great One” compared the 23-year-old Makar to Bobby Orr, considered the greatest defenseman of all-time. Makar has led the Avs throughout the playoffs with 29 points on 8 goals and 21 assists. Makar’s 2019 Upper Deck Young Guns Rookie PSA 10 has skyrocketed in the last year, growing 150.64%. Makar is already a Calder Trophy winner, as he was the top NHL rookie in 2019-20. He also won the Conn Smythe and Stanley Cup at age 23.

Losers

1. Juan Soto

4. Jayson Tatum

SlabStox Bottom Line

- Free falling. If you hold cards of players that are DOMINATING in the playoffs, you better be ready to sell if you’re looking to take profit. Once a playoff run ends (win or lose), oftentimes the cards come back to earth (or fall to the core in Tatum’s case).

- Offseason moves. If you are extremely impressed by a player whose cards rise in the playoffs, take the offseason as the perfect opportunity to invest for the long-term. If you bought Giannis in the offseason after they blew a 2-0 series lead on the Raptors in 2019, you’d be a very happy buyer right now.

TAKEAWAY 5: What’s Coming & What to Watch

We want to end our market report with a look ahead. Here is what’s on our mind for the coming months. Let us know what you’re thinking about—we just may cover it in our next SlabStox Monthly Card Market Report.

1. The Fanatics Effect

Where does Fanatics Collectibles, now holding the lion’s share of the card market including the Topps brand and most of the major sport licenses, lead the market during the second half 2022? It’s an unanswered question.

The market has gotten a peek at some things Fanatics is rolling out—direct to consumer selling, blind dutch auctions for zerocool cards products, more transparent reporting on product runs (zerocool)—but there are many unanswered questions.

-

- When will new sports products be released?

- Will they be flagship brands (Topps, Bowman) or Fanatics?

- What is the timing of releases?

- What is the distribution model for local card shops?

There are so many unknowns, but we’ll be watching.

2. Panini Quality

We’ve reported a number of quality issues coming out of Panini last month. Here are a few that we covered in June:

- Empty box of Panini Optic Contenders Football

- Imagine you buy a box of 2021 @paniniamerica Optic Contenders FOTL at the floor price of $675, you get your box in the mail, open it, and there’s NOTHING inside. Well, that just happened to @mikeybcards. The damaged cards are one thing, but no cards at all? Has anything like this ever happened to you? (NOTE: To Panini’s credit, they quickly replaced the empty box.)

- Wrong 1/1 Autograph

- A MONSTER Reece James Obsidian Dual Patch Auto 1/1 was hit on Obsidian Soccer release day by @tanpulls for @joeyc_cards… but @paniniamerica put the wrong autograph on it. Instead of it being an auto of the Chelsea superstar, it was Heung-Min Son’s autograph (forward for Tottenham Hotspur). Son was one of the best Premier League players this season (23 open play goals), but on such a huge card, it’s less than ideal. Would you request a replacement if you pulled this?

- Impossible to grade this corner

- We’ve seen the back damage, we’ve seen the poor centering…but how about a missing corner?! @mjbreaks pulled this monster Ja’Marr Chase Prizm Gold RC /10 except the bottom right corner is chopped off. The QC on 2021 Prizm has lacked quality. What do you think this would grade?

With Fanatics Collectibles likely having more impact on the second half of the year, what does Panini need to do to step-up its game? More importantly, will they secure various sport license deals that are now running out?

3. The National and other shows

Some plan all year for The National. This year it returns to the East Coast—Atlantic City, N.J., July 27-July 31.

It’s SlabStox’s first time in AC (2020 was canceled due to COVID-19), so we really don’t know what to expect. Be sure to visit us at Booth 1461; @CardCollector2, Booth 1560; and Card Talk, Booth xxxx.

This is what we do know:

- The market dynamics will be different than last year. Vendors will be picky with what they buy and attendees will be more budget conscious.

- Shameless plug—SlabStox’s Camp Kesem Charity Night will be held through multiple online events leading up to The National and will culminate at the popular Trade Night hosted by @CardCollector2 and @RoadShowCards. To participate and contribute to Camp Kesem Charity, check out this video and watch here to see last year’s results.

Shows worth checking out

- July 1-2

- A-Z Cards and Collectibles, Clovis, CA

- Fort Lauderdale Card Show, Ft. Lauderdale, FL

- July 7-10

- (July 7-9) S&B Sports Promotions Sports Card & Memorabilia Show, North Wales, PA

- (July 9-10) GG2 Sportscard Show, Springdale, AR

- Garden State Trading Card Show, Hasbrouck Heights, NJ

- (July 9-10) Bay Area Sports Card Show, Clearwater, FL

- July 14-17

- Dallas Card Show, Allen, TX

- July 22-24

- (July 22-23) Tampa Bay Sports Card Show, Tampa, FL

- Battlefield Mall Sports Card Show, Springfield, MO

- July 27-31

- The National Sports Collectors Convention, Atlantic City, NJ

4. July Product Releases

Many product releases have been delayed by manufacturers due to supply chain issues. The release dates below are subject to change by the manufacturer. Dates provided by Cardboard Connection.

July 1:

2022 Select UFC

July 6:

2021 Topps Chrome Bundesliga

July 8:

2021 Prizm NBA

2021 Finest Bundesliga

July 13:

2021 Topps Finest UEFA

July 15:

2022 Prizm WNBA

July 20:

2021 National Treasures Basketball

2021 Optic Football

2022 Bowman Chrome Road to UEFA U21 Euros Soccer

July 27:

2021 Select Football

July 29:

2021 Impeccable Premier League Soccer

5. August Barometer for the Card Market

This time of year is funky for the card market. We’re in the middle of the baseball season, football camp begins at the end of the month and with the 2022 basketball draft complete, all eyes are on the NBA offseason and where players move.

McGill from Card Ladder perhaps summarized it best, and it is worth sharing:

“It’s a very interesting time of the year in the hobby. There isn’t a lot of sports news and sports headlines from the Big 3 sports that will fire people up to go out there and buy cards. It’s always interesting to watch and see how it unfolds. When we start ramping up to football season and basketball season coming back, and that overlaps with the playoffs in baseball, the lead up to that will be a good test of our market. Will we see prices climb up again or not? That’s going to be the real test—August will be a good indicator of where we’re at.”

SlabStox Last Word

- Reasons to sell. Just like other markets (stocks, crypto, NFTs), people are selling for a multitude of reasons. Maybe people need living expenses, maybe people are saving for The National to buy that grail when they find it on the dip, or maybe people just don’t believe in a certain card as a long-term investment anymore.

- Buy on the dip. While selloffs create short-term price drops, it could also create opportunities that might not have presented themselves. If you have the disposable funds, it might be time to focus on a few cards you want to stash away long-term. If you believe in the hobby and collecting for the long haul, view this as a time to secure cards you may not otherwise see for sale.

- The X-factor. The real barometer for hobby health is not the day-to-day fluctuations in price. It’s the excitement that collectors have for not only the cards themselves, but to be involved in a great hobby with others like themselves. We experienced a tremendous amount of excitement at the Midwest Monster in Indianapolis in June, and we cannot wait to see the amount of collectors that show up to Atlantic City in July!