SlabStox Card Market Report: September 2022

Aaron Judge and Albert Pujols gave us a record chase to remember, football’s young QBs are shaking out and there are some new superstars on the court and card buyers are noticing. Quarter 3 of the 2022 calendar year has come to a close—football cools down as basketball and hockey heat up. Here’s what we’re talking about in this SlabStox September Card Market Report:

- Take 1: HR record chasers set fire to baseball card sales

- Take 2: Elite young QBs emerge

- Take 3: US Open puts tennis on the radar

- Take 4: Markets at a glance

- Take 5: Who’s Hot / Who’s Not

- Looking ahead—Shows worth checking out / Product Releases / SX Final Word

Join the CardTalk/SlabStox Pod. SlabStox and CardTalk collab each month to dig deeper into this market report, bringing you debate, analysis and fun. Stay tuned to social media for updates.

If you want to receive this SlabStox Trading Card Market Report every month in your inbox, subscribe to SlabStox’s Daily Slab newsletter,

DISCLOSURES:

- All market data in this report is from Card Ladder. Card Ladder is an independent, third-party partner of SlabStox, providing card collectors and investors insights to make informed, up-to-date data-driven decisions. Every investment and trading move involves risk. You should conduct your own research before making a decision.

- The only cards owned by SlabStox of players in this report is Jonathan Taylor.

5 Hot Takes from the September sports card market

Take 1: Pujols and Judge make baseball fun again

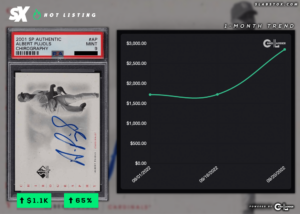

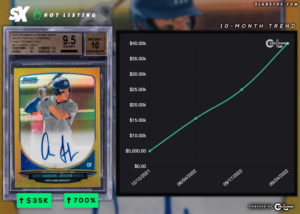

Baseball enjoyed more than one moment in the spotlight in September. Home run sluggers Albert Pujols and Aaron Judge owned the sports (and sports card) headlines as each chased milestones from the plate and proved hitters can still crush the ball and record books post steroid era.

It’s been a long time since we could cheer players approaching these milestones. Pujols became the fourth player to hit 700 home runs in a career, the first since Barry Bonds did it in 2004. Pujols did it in style, hitting both 699 and 700 in the same game (9/23/22).

Judge kept us hanging a bit longer. After hitting his 60th home run mid-month, he went seven games without a dinger until September 28 when he tied Roger Maris’ Yankee (and AL) record of 61 against the Toronto Blue Jays.

Both players were in the white-hot spotlight—their card sales have been impressive (however, think twice before jumping into this hot market as it is likely to drop):

- Pujols’s 2001 SP Authentic Chirography RC Auto PSA 9 sold for $2,850 on 9/20/22 PRIOR to HR #700, a 66% increase since a $1,721 sale on 9/1/22.

- Judge’s 2013 Bowman Chrome Gold Auto /50 BGS 9.5/10 may have been the best investment of the year. At one point it was purchased for $5,000 (12/12/21), the card skyrocketed to $40,000 (9/24/22) by the time he hit No. 61. Not only that, but it sold for $25,000 on 9/17/22. That’s a $15,000 increase in ONE WEEK!

SlabStox Bottom Line

In a time where finding cards increasing is difficult, Judge and Pujols aren’t only beating the odds, they’re CRUSHING the odds. Records and milestones matter for legacies, and both of these players are adding to theirs. When it’s all said and done, big legacies create long-term collectors. Pujols is there, and Judge is well on his way.

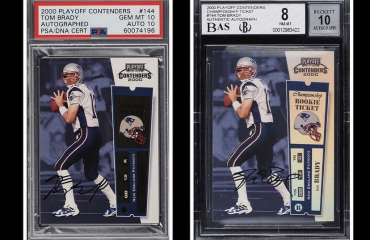

Take 2: Young QBs emerge beyond Mahomes, including a $1M sale

The chase for the next GREAT quarterback has grown to a fever pitch in recent years and the start of the 2022 NFL season was no different. The run up for young QB sports cards went exactly as expected — wild speculation and investment (which some would call gambling).

No card sale reflects that more than the Justin Herbert 2020 National Treasures NFL Shield RPA 1/1, which sold for $1,800,000 on auction on September 10 (one day before the 2022 NFL Sunday kickoff), outselling a Michael Jordan/LeBron James/Kobe Bryant 2006 Exquisite Triple

Logoman 1/1 in the same auction by more than $120K. That’s astounding considering this is a card of a third year player yet to make a playoff game, and it outsold many of the most important sports cards ever made.

While the football market has expanded beyond QBs, the most hype is always focused on QBs trying to take the next step, either making the Super Bowl or contending for one in the near future. That, plus strong performances in the opening weeks created some quick risers on the QB chase list. Top players in September:

- Josh Allen, Buffalo Bills. His CL Player Index rose 18% over the six months since last season ended on an amazing playoff loss performance to the Chiefs.

- Jalen Hurts, Philadelphia Eagles. On the back of Hurts, his Eagles are the only undefeated team left in the NFL. His CL index increased 144% since last season.

- Tua Tagovailoa, Miami Dolphins. He started out 3-0. His CL player index rose 38%. The challenge now: He finished the month on a stretcher after the Dolphins concussion protocol controversy.

- Lamar Jackson, Baltimore Ravens. He’s dominating every level of the game right now. He leads the league in total TD (13). Even with that hot start, his CL index only increased 0.30% in the month of September (compared to +37% for Hurts in September).

While some quarterbacks emerged to turn profit for collectors, more quarterbacks have fallen into the “loss” category. Trey Lance and Mac Jones’ injuries combined with some poor performances crippled their markets. Justin Fields’ straight up inability to throw a football has tanked his market

Jones and Fields’ 2021 Prizm Silver RC PSA 10s decreased 33% in September, with even bigger losses since the summer. The decrease doesn’t only represent their lack of success, but also the increase in the PSA population report leading to more supply on the market.

Trey Lance’s injury was our first glimpse this season at how an injury affects a card market. The result of the injury combined with an already declining market from the huge hype prior to the season is… not pretty.

SlabStox Bottom Line

Keep this bit of knowledge in your back pocket for next year’s football season kickoff. Every year we see wild speculation in the quarterback market, particularly for strong QB classes (i.e. 2018 and 2020). However, only a few will pan out, and by Week 3, those who don’t drop like a rock. Be careful. Look into players who you believe are on the verge of taking the next step toward greatness. Often, that comes down to quality players surrounding the QB and a little luck escaping the injury report.

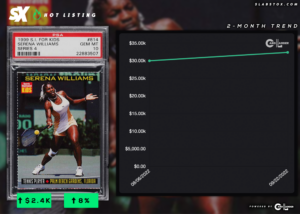

Take 3: Tennis—a new card market after the US Open

The US Open concluded on September 11, and this year’s event included some of the most powerful stories the sport has seen along with a most timely “product” release. This years US Open provided momentum for the tennis card market:

- Serena Williams made an emotional final Grand Slam appearance and signed off after the second round. Many have called her the greatest of all GOATs. Her 1999 SI For Kids RC PSA 10, a card that was once $117,000, sold for $32,400 on 9/22/22. It did experience a small increase from an August sale (+8%).

- Men’s single winner Carlos Alcaraz (ranked #1, Spain) survived a marathon semi-final and captured his first ever Grand Slam singles title at the age of 19. NetPro cards released an exclusive Carlos Alcaraz rookie card and auto collection just weeks before the US Open, their first card release since their major 2003 release, which featured rookie cards of Federer and Nadal. The limited series of Alcaraz tennis cards sold out quickly and the values exploded on the secondary market. The Retro Dual Patch RC Auto /50 retailed for an average price of $3,250, and the first graded copy (PSA 8/10) sold for $32,400 on 9/24/22.

- Frances Tiafoe (ranked #19), US men’s single semi-finalist, stood toe-to-toe with Alcaraz in a 4-hour match and won the hearts of American fans. His 2018 Goodwin Champions auto market exploded, with the most recent Nickname RC Auto selling for $200 on 9/15/22. Just two weeks earlier, there was a sale of $75 on 9/3/22. Less than a year earlier, there was a sale of $15 on 12/18/21.

- Roger Federer announced his retirement mid-September after an impressive and dominant career that included 20 Grand Slam titles. A 2003 Netpro Elite Glossy RC /100 PSA 10 of his sold for $9,281 on 9/19/22, an 11% increase since the previous sale on 5/4/22.

SlabStox Bottom Line

Exercise caution with big increases in categories like tennis. The overall supply of these cards is very small compared to the major sports, so it doesn’t take much demand to increase the top chases. Once that short-term demand is satisfied, the resulting sales have a potential to drop in price. That’s not to say tennis doesn’t have a long-term future in the sports card market, as it is a global sport with a large following.

Take 4: Other indexes may indicate rough card market ahead

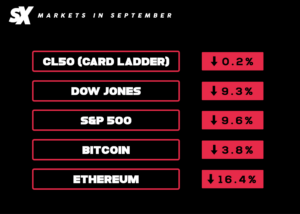

As stocks take a beating with rising interest rates to control inflation, the Card Ladder 50 (CL50), a representative index of 50 highly transacted cards to reflect the overall trading card market, has remained steady, losing only one-fifth of a percent in September. During the third quarter, the CL50 increased 14.31%, but it dropped 0.94% for the year.

What does this mean? If you’ve read past market reports, you’ll know the card market and the CL50 often “lag behind” other markets, sometimes by a month or more due to the time it takes for transactions to occur. When we update these numbers after October, there is a good chance we might see some of the stock market drops take effect in the card market.

While the CL50 shows stability overall, some cards took huge hits. The MJ 1996 Fleer PSA 9 that was sitting at $28,000 one year ago has been nearly cut in half, as it reached its lowest point since August of 2020. In the month of September it lost 32% of its value.

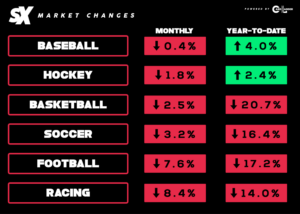

Diving deeper into the individual sports card categories:

- Baseball remains strong with fans glued to the Judge and Pujols record home run chases.

- Football cooled as the season kicked off and teams began to flourish or struggle. There were, however, gains to be made with specific players.

- Basketball and hockey pick up with season openers next month.

- Where’s the World Cup boost? Less than 2 months out from soccer’s biggest stage, and the card category has yet to see the bump many were expecting.

- Racing is down — big time. F1 has cooled with the 2022 Drivers Championship likely decided (Max Verstappen) and the excitement levels lower than last year’s head-to-head battle between Max and Lewis.

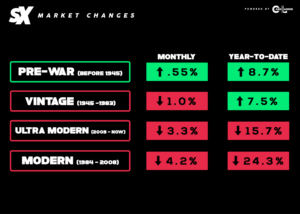

For perspective: We discussed in last month’s Market Report episode how in the future, we most likely will see Pre-War and Vintage start to turn red. The Vintage index decreased 1%, while Pre-War saw marginal gains. It’ll be interesting to check-in on this in six months.

SlabStox Bottom Line

Make sure you’re always paying attention to which sports are hot and which sports are not. This might not always play out, but more often than not, what’s hot at the moment will be cool six months later (see, Racing and Football).

Take 5: Who’s Hot / Who’s Not

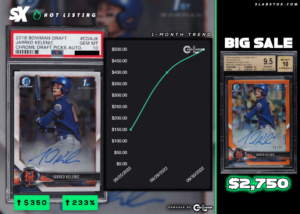

- Jarred Kelenic’s hot September led to the Mariners first playoff appearance in 21 years, and of course, that led to a hot card market. His 2018 Bowman Chrome 1st Auto PSA 10 bounced back to $500 on 9/30/22 after touching an all-time low ($150) in the same month.

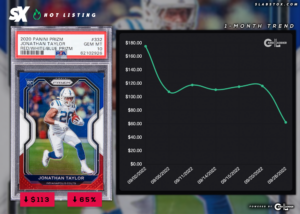

- Outside of beating the Chiefs, the Colts have been rather underwhelming. Along with that, so has Jonathan Taylor, and it’s leaving fantasy owners and collectors wondering what the problem is. He’s rushed for 328 yards and just one TD. While those numbers exceeded last season through Week 4 (274 yards and one TD), the expectations were far higher to start this season.

Looking Ahead: NHL and NBA Seasons Begin

October 7 and October 19. Those are two days to circle on your calendar as the NHL (7) and NBA (19) seasons get underway. There has been some positive movement in each market, but it always is player and card dependent, especially in a down market like we’re in right now. If you’re looking to participate in each market, be sure to tune into the games each night, as at the beginning of the season, hot players sell better than throughout the rest of the season. We’ll see you in the next month’s market report to break down the biggest movement!

Sports Card Shows Worth Checking Out

Oct. 1-2:

- (Oct. 1-2) A-Z Cards and Collectibles, Clovis, CA

- (Oct. 1) Fat Daddy’s Sports Card Show, Oak Creek, WI

- (Oct. 1) The Flip Sports Card & Collectibles Trade Show, Huntsville, AL

- (Oct. 1-2) Cranston Sports Card Show, Coventry, RI

- (Oct. 2) West Palm Beach Sports Cards & Collectibles Show, Greenacres, FL

- (Oct. 2) East Cobb Sports Collectibles Show, Atlanta, GA

Oct. 6-9

- (Oct. 6-9) Las Vegas Card Show, Las Vegas, NV

- (Oct. 7-8) Fort Lauderdale Card Show, Ft. Lauderdale, FL

- (Oct. 7-9) Battlefield Mall Sports Card Show, Springfield, MO

- (Oct. 8-9) Syracuse Sports Card Show, East Syracuse, NY

- (Oct. 8-9) Shreveport Card Show, Shreveport, LA

- (Oct 8-9) Twin Oaks Card Show, Portland, OR

- (Oct. 9) Mid-Atlantic Sports Collectibles and Memorabilia Show, Silver Spring, MD

Oct. 14-16

- (Oct. 14-16) Sportscard & Sports Collectible Show, Maplewood, MN

- (Oct. 15) Northwest Valley Coin & Card Show, Phoenix, AZ

- (Oct 15) J&J All Star Sportscards Shows, Milltown, NJ

- (Oct. 15) Winchester Sports Card, Collectibles and Comic Book Show, Winchester, VA

- (Oct. 15) Twin Sports Cards Petoskey Card Show, Petoskey, MI

- (Oct. 16) Greencastle Sports Card & Memorabilia Show, Greencastle, PA

Oct. 21-23

- (Oct. 21-23) The Chantilly Show, Chantilly, VA

- (Oct. 22) Bat City Sports Card Show, Austin, TX

- (Oct. 22) Mid-South Sports Cards and Collectibles Show, Bartlett, TN

- (Oct. 22) Cards & Collectibles Fall Show, Denver, CO

- (Oct. 22-23) Twin Oaks Card Show, Everett, WA

- (Oct. 23) Primetime Card Show, New Britain, CT

Oct. 28-30

- (Oct. 28-30) The Hawke’s Nest Sports Card & Collectible Show, Eau Claire, WI

- (Oct. 28-29) Tampa Bay Sports Card Show, Tampa, FL

- (Oct. 29th) Jackson Sports Collectibles Show, Jackson, MI

- (Oct. 29-30) The Best Weekend Card Show, Woburn, MA

- (Oct. 30) Sports Card & Collectible Show, Wilmington, DE

October: Important Product Releases

Many product releases have been delayed by manufacturers due to supply chain issues. The release dates below are subject to change by the manufacturer. Dates provided by Cardboard Connection.

Oct 5:

2021 Mosaic Road to the FIFA World Cup

Oct 12:

2022 Topps Update

2022 Panini Prizm WNBA

Oct 19:

2022 National Treasures Road to the World Cup (moved from Sept.)

2021 Spectra Basketball

2022 Topps Chrome Sapphire MLS

Oct 26:

2021 Select Basketball

2022 Panini Prizm NASCAR